Trading Losses – reliefs in current tax year, carry back - ACCA Taxation TX-UK lectures

ACCA I Advanced Taxation (ATX-UK) I Groups & Consortia - ATX Lecture 20 I FA 2023Подробнее

ACCA I Advanced Taxation (ATX-UK) I Corporation Tax Losses - ATX Lecture 19 I FA 2023Подробнее

Chapter 17 Tax Adjusted Losses – Companies (part 2) - ACCA TX-UK Taxation (FA 2023)Подробнее

Chapter 17 Tax Adjusted Losses – Companies (part 1) - ACCA TX-UK Taxation (FA 2023)Подробнее

GROUP RELIEF with Kit Questions – ACCA Taxation (TX-UK) - March 2023 AttemptПодробнее

ACCA I Advanced Taxation (ATX-UK) I Cessation of Unincorporated Business - ATX Lecture 4 I FA 2023Подробнее

Chapter 17 Tax Adjusted Losses – Companies (part 3) - ACCA TX-UK Taxation (FA 2023)Подробнее

ACCA I Advanced Taxation (ATX-UK) I New & Ongoing Unincorporated Business - ATX Lecture 3 I FA 2023Подробнее

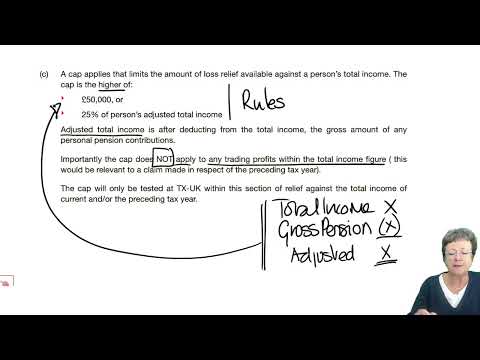

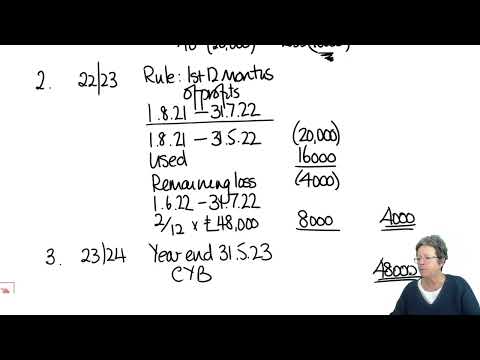

Chapter 6 Tax Adjusted Trading Losses – Individuals (part 1) - ACCA TX-UK Taxation (FA 2023)Подробнее

Trading Losses for Companies (Complete) – ACCA Taxation (TX-UK) {March 2023}Подробнее

Tax Adjusted Trading Losses – Individuals (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Losses – Companies (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Losses – Companies (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

GROUP RELIEF with Kit Questions – ACCA Taxation (TX-UK) Exam FA2022Подробнее

TX Topic Explainer: Loss reliefs (for individuals and companies)Подробнее

Trading Losses for Companies (Complete) – ACCA Taxation (TX-UK) {December 2023}Подробнее

Partnerships - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Trading Losses – Individuals (part 3) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Trading Losses for Companies (Complete) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

GROUP RELIEF with Kit Questions – ACCA Taxation (TX-UK) - December 2023 AttemptПодробнее