Trading Losses for Companies (Complete) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)

ACCA Taxation TX (UK) in English - Exam Guide, Exam Pattern and Syllabus (March 2024 ATTEMPT)Подробнее

TAX PLANNING (Revision Kit Q114 FLEUR) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

Trading Losses for Individuals (COMPLETE) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

Corporation Tax (Complete) – ACCA Taxation (TX-UK) Exam FA2022Подробнее

TRADING INCOME (Allowed and Disallowed Expenses) – ACCA Taxation (TX-UK) Exam FA2022Подробнее

TAX ADMINISTRATION FOR COMPANIES – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

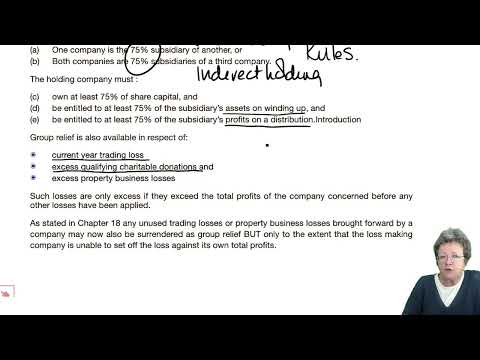

GROUP RELIEF with Kit Questions – ACCA Taxation (TX-UK) Exam FA2022Подробнее

Partnerships (Complete) – ACCA Taxation (TX-UK) Exam FA2022Подробнее

TRADING INCOME (CASH BASIS FOR SMALL BUSINESSES) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

Trading Profit – Basis Periods (part 3) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Chargeable Gains – Companies – Reliefs - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Corporation Tax – Groups (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Corporation Tax – Groups (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

How to calculate PROPERTY INCOME (Part 02) – ACCA Taxation (TX-UK) Exam FA2022Подробнее

Tax Adjusted Losses – Companies (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Trading Losses – Individuals (part 4) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Losses – Companies (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals (part 4) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее