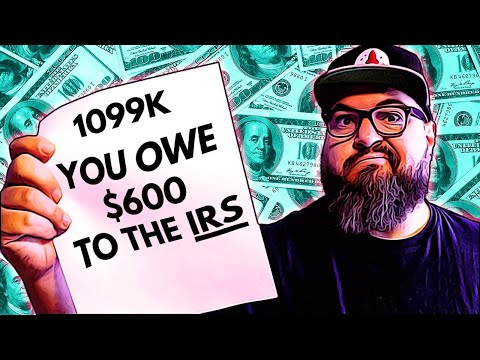

REPORTING $600 *CASH.APP* Transaction TO THE IRS. New Tax Law EXPLAINED! Answering 'Questions.

Newest IRS $600 Taxes ExplainedПодробнее

PayPal, Venmo, Cash App required to report transactions exceeding $600 to IRSПодробнее

How the IRS catches you for Tax EvasionПодробнее

🔴 IRS DELAYS $600 THRESHOLD FOR 1099-K REPORTING | CASH APP REPORTING DELAYEDПодробнее

IRS $600 rule for 2022-cash app, pay pal, Venmo-1099K FormПодробнее

REPORTING $600 *CASH.APP* Transaction TO THE IRS. New Tax Law EXPLAINED! Answering 'Questions.Подробнее

UPDATE ON $600 VENMO REPORTING 🚨 #money #venmo #taxesПодробнее

New IRS $600 Tax Rule for 2024 (Venmo - Cash App - PayPal)Подробнее

Does Zelle Report to the IRS?1099-K reportingПодробнее

New IRS Tax Law for Venmo, PayPal, Cash App $600+ Commercial TransactionsПодробнее

Venmo, PayPal, Cash App to Report Transactions of $600 or More to the IRS This YearПодробнее

IRS 10 Year Rule Explained: How Your Tax Debt Can Disappear AutomaticallyПодробнее

IRS TAX CHANGES CashApp PayPal Venmo Zelle & ALL CASH TRANSACTIONS TRACED & TAXED💵 #1099KПодробнее

If You Use Venmo, PayPal, Or CashApp For Your Business, The IRS...Подробнее

IRS to crack down on tax reporting from Venmo, PayPal and Cash AppПодробнее

The IRS Tracks Your Venmo & Cash App! 🕵🏻♂️Подробнее

clarity on some big changes #taxseason2023 #gavinlarnard #irs #cashapp #venmo #zelle #paypal #taxesПодробнее

Did the IRS delay $600 tax for Venmo, Paypal apps?Подробнее

Payment Apps Now Required To Report Annual Transactions Over $600 To IRSПодробнее

NEW TAX LAW REQUIRES CASH APPS REPORT TRANSACTIONS OF $600 TO THE IRS | PAYPAL ZELLE - (NEWSMAX)Подробнее

AVOID the New Venmo and Cashapp Tax! 😡 #shortsПодробнее

IRS and cashappsПодробнее

What Transactions Do Banks Report to IRS?Подробнее