Income Tax Deductions: All Deductions u/s Section 80C to 80U for FY 2023-24 & FY 2024-25

New Tax Regime Deductions | Deduction in New Tax Regime | New Tax Regime Exemption FY 2024-25Подробнее

Budget 2024 - Deductions in New Tax Regime | New tax regime 2025 | New tax regime vs Old tax regimeПодробнее

Deduction Under 80C to 80U | Deduction under Section 80c to 80u | Income Tax Deduction 2024-25Подробнее

Form No 10-IA for deduction Section 80DD & Section 80U | how to file form Form No 10-IA | Form 10 IAПодробнее

ITR-4 filing online FY 2023-24 & AY 2024-25 for Business & Profession | How to file ITR 4Подробнее

BEST ITR filling TUTORIAL for SALARIED EMPLOYEES | Old & New Tax Regime | ITR 1 AY24-25Подробнее

Form 10-IA For 80-U Disability Deduction Online Filing Live & Free For AY 2024.25 FY 2023.24Подробнее

How to Select Old Tax Regime in ITR | Old Tax Regime in ITR Filing | How to Choose Old Tax RegimeПодробнее

New Tax Regime Deductions | Deduction in New Tax Regime | Exemption New Tax Regime 2024-25Подробнее

Medical Insurance Tax Benefits | Section 80D | Ayushman Bharat schemeПодробнее

Income Tax Deductions: All Deductions u/s Section 80C to 80U for FY 2023-24 & FY 2024-25Подробнее

Deductions 80C To 80U | Income Tax Deductions Chart | Deduction 80C To 80U Under Income TaxПодробнее

Section 80U – दिव्यांग व्यक्तियों को आय से कटौती | Section 80U Deduction for disabled persons in ITRПодробнее

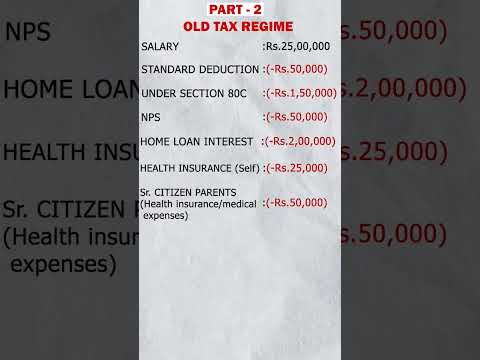

Old Tax vs New Tax Regime (FY 2023-24):Which one would you choose? Let's understand with an exampleПодробнее

Deductions in New Tax Regime AY 24-25 | New tax regime 2024 | New tax regime vs Old tax regime 2024Подробнее

Sec. 80d 80dd, 80ddb A.Y 2023-24| Medical tax benefits| Deduction for medical expenses income tax|Подробнее

Tax Benefit on Disability u/s 80U & 80DD | How to Claim Deduction for Disability in Income TaxПодробнее

Deductions in income tax, deduction under 80c to80u, deductions under chapter vi a, taxation lawsПодробнее

Income Tax Deductions Under sec 80C to 80U | Chapter IV Deduction IncomeTax | Tax Saving Tips 2021Подробнее