Excel Finance: Stock Expected Returns & Standard Deviation | Probability | Estimating Future

Expected Return and Variance of Individual Stock Returns (Using Excel)Подробнее

Expected Return and Standard Deviation of a stock with probability Calculation | Risk ManagementПодробнее

Lec 7: Expected return, risk and covariance of returnsПодробнее

Download stock price history and calculate expected return, standard deviation, covariance on ExcelПодробнее

Expected Return and Standard DeviationПодробнее

Standard Deviation and Coefficient of VariationПодробнее

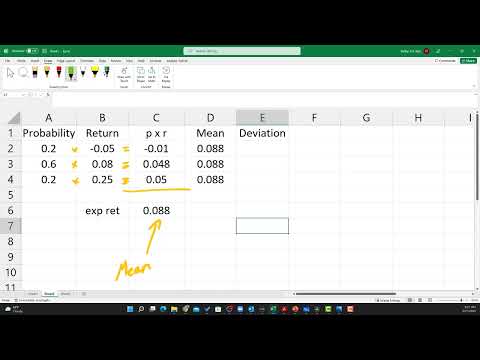

How to calculate a stock's expected return, variance, and standard deviation using probabilitiesПодробнее

Excel Finance: Stock Expected Returns & Standard Deviation | Probability | Estimating FutureПодробнее

Standard Deviation and expected Return. Scenario Analysis Measure Risk Investment Course. CFA exam.Подробнее

Portfolio return, variance, standard deviationПодробнее

Calculation of Standard Deviation when probability is not givenПодробнее

How to Calculate Expected Return, Variance, Standard Deviation in Excel from Stocks/SharesПодробнее

Single Asset Risk MeasurementПодробнее

PortfolioTheory: Two Asset Portfolio Efficient Frontier through Excel - Part 2Подробнее

Expected return, VarianceПодробнее

CH 06 A 16e 06092019Подробнее

Topic #10 Portfolio Risk and Return and Efficient FrontierПодробнее

Calculating Expected Portfolio Returns and Portfolio VariancesПодробнее

5 Calculating 3 stock Portfolio Expected Return and Risk AnalyticallyПодробнее

(7 of 20) Ch.13 - Calculation of expected return, variance, & st. dev.: example with 2 stocksПодробнее