#6 - 5%, 12%, 18% & 28% Rate for Collection of Tax - Levy and Collection of Tax : GST of INDIA

GST MCQ: 91 MCQs on Goods and Services Tax (GST) for AAO Exam and PS Group B Exam: Career PostПодробнее

5%, 12%, 18% & 28% Rate for Collection of Tax - Levy and Collection of Tax (Part -6): GST of INDIAПодробнее

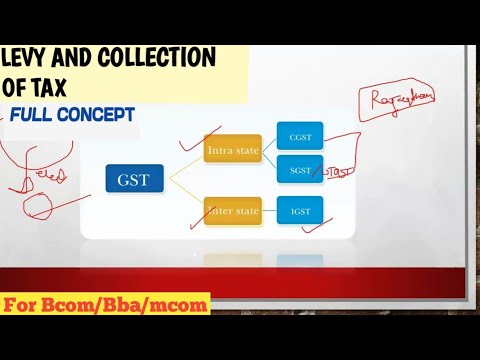

Levy And Collection of GST bcom | Levy And Collection Of CGST/SGST/UTGST And IGST | Full ConceptПодробнее

11. Levy and Collection of GST | Levy & Collection of CGST/IGST/SGST/UTGST, Value of Levy, RatesПодробнее

DAY 0 | GST LAW AND PRACTICE | V SEM | B.Com | NEP | INTRODUCTIONПодробнее

#6 - 5%, 12%, 18% & 28% Rate for Collection of Tax - Levy and Collection of Tax : GST of INDIAПодробнее

GST TAX SLAB, 0%, 5%, 12%, 18%, 28% TAX ON GOODS AND SERVICES.Подробнее

GST Tax Slabs || 0%, 5%, 12%, 18%, 28% || किस पर कितना लगेगा || Tally Course in HindiПодробнее

#1 TYBCOM LEVY AND COLLECTION OF TAX | INDIRECT TAX |TYBMS |SEM 6 | MUMBAI UNIVERSITYПодробнее

Sem 6 - Indirect Tax - GST - Levy & Collection of Tax - RCM on goodsПодробнее

Type Of Taxes under GST #Shorts #TypeOfGSTПодробнее

GST Rates for all Items : 0%, 5%, 12%, 18%, 28% GST Tax ItemsПодробнее

GST List Items that will have 28% exemptionПодробнее

L-5 Levy and collection of Tax. Liability to pay GST• Power to grant exemption from Tax (Section 11)Подробнее

12. Levy and Collection of GST | Composition Scheme under GST, GST Rate under Composition SchemeПодробнее

GST || CHAPTER -3 || SECTION -9 ( Levy & Collection)Подробнее

What is G.S.T | G.S.T क्या है | Types of GST | GST Return | GSTIN | Khan GS Research CentreПодробнее

GST Notes Only Video Part 6 Levy, Tax. collection & Reverse charge MechanismПодробнее

Calculate CGST & SGSTПодробнее