Remuneration provision related to partnership firm #shorts #incometax #partnership #salary #bizfoc

Types of Partnership Deed #shorts #shortsfeed #partnership #partnershipact1932Подробнее

How do you calculate the remuneration for partnership firms?Подробнее

Concept of Types of Partners & Partnership #shorts #shortsvideo #education #partnershipПодробнее

Salary & Remuneration Rules of Taxation for Partnership Firm | Section 40(b) and Section 184Подробнее

Important Partner Provision | Taxability of salary and remuneration in case of partnership businessПодробнее

partner salary in partnership firm | Remuneration and Interest deduction in Partnership Firm or LLPПодробнее

Partnership deduction on Salary | Remuneration to Partners under section 40b With Interest CalculateПодробнее

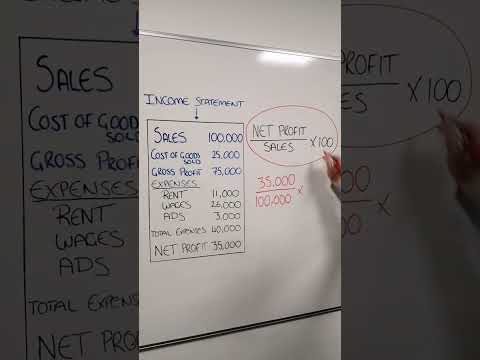

How do you calculate your net profit margin?Подробнее

Yeh Partnership Remuneration mein "Book Profit" kya hota hai?Подробнее

New Tax Rules of Partnership Firms | Partners Salary calculation | 194T TDS on Partners paymentsПодробнее

Remuneration Paid for Accounting Assistance Tax Deductible from Other Income? TIPS by Mukesh PatelПодробнее

How a Partner may offer Income from Firm in his Personal ITR (Hindi)Подробнее

Maximum Remuneration allowed to Partner in case of Taxability of Partnership firmПодробнее

Change of PAN if Partnership Firm is Converted in LLP | Question & Answer Session | Shorts |Подробнее

Taxation Rules of Remuneration & Interest Received by Partners from Partnership FirmПодробнее

Allowable Salary / Remuneration to partner under income tax act 196 , calculation of partner salaryПодробнее

Partnership firm me partner ko salary v capital interest kitna de sakte he? Partnership account|KSRПодробнее

Partnership firm or Company ?#finance#shorts#shortvideos#viralvideosПодробнее

Partnership Firm #partnershipПодробнее

Consequences of not executing Partnership Deed#partner#deed#partnershipdeed#salaryПодробнее