Refund of IGST Paid on Export of Goods | Refund of IGST

GST REFUND FOR EXPORT WITH PAYMENT OF IGST - HOW GST WORKS IN EXPORT, - IN GUJARATI LANGUAGEПодробнее

HOW TO GET GST REFUND IN EXPORT? EXPORT WITH PAYMENT OF IGST VS EXPORT UNDER LUT COMPARISONПодробнее

How to get GST refund for exports? GST Refunds under LUT, with payment of IGST, GST refundsПодробнее

GST Refund | How to get GST refund on export | GST refund with payment of IGST |Export Refund of GSTПодробнее

IGST refund on commercial ExportПодробнее

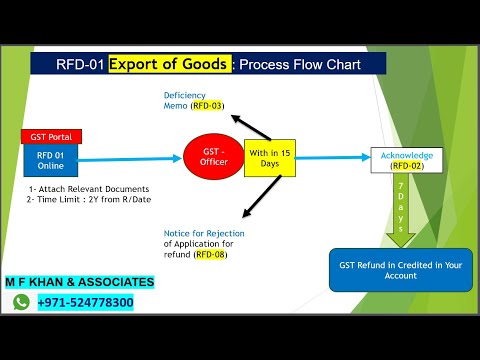

GST Refund | GST Refund Process for Export under LUT | GST Refund Procedure | RFD 01 Full ProcessПодробнее

EXPORT WITH PAYMENT OF IGSTПодробнее

0.1% GST FOR MERCHANT EXPORTERS - EXPORT UNDER LUT BY MERCHANT EXPORTERS 0.1%Подробнее

🎉GST Refund on Export - Most awaited Relief | Recent GST Council Recommendations | GST with SaradhaПодробнее

Regularization of IGST refund where exporters had imported certain inputs without payment of IGSTПодробнее

GST Refund Webinar by CA Sachin M Jain Part-1Подробнее

Final Paper 5: ITL | Topic: Chapter 14 to 24 | Session 2 | 30 June, 2024Подробнее

GSTIN notifies Refund of additional IGST|RicagoПодробнее

HOW TO GET #IGST REFUND IN EXPORT OF GOODS WITH PAYMENT OF TAX | IGST REFUND | #gstrefunds #gst |Подробнее

NEW GST REFUND PROCEDURE | GST LATESET ADVISORY | GST NEW NOTIFICATION 12/2024Подробнее

How to make E invoice of Export in tally prime 2024 lПодробнее

Avoid Mistakes: Step-by-Step Process for GST Refund on ExportПодробнее

Refund of additional IGST paid on exportsПодробнее

Export - GST Refund Process with practical case | Step by Step Process of GST RFD01|Подробнее