Quick IRR Calculation in LBO Models

Paid-In-Kind (PIK) Interest: Full Tutorial for LBO ModelsПодробнее

How to Build a Leveraged Buyout (LBO) Model in 5 Steps! (FREE Excel Included)Подробнее

The Rule of 72 (with Private Equity Interview Questions)Подробнее

The Twitter Buyout: Is Elon Musk a Madman or a Genius?Подробнее

LBO Modeling Test: Full Walkthrough of a 60-Minute Test (Blank Sheet)Подробнее

Cash-Free Debt-Free Deals in M&A and LBOs (Version 2.0)Подробнее

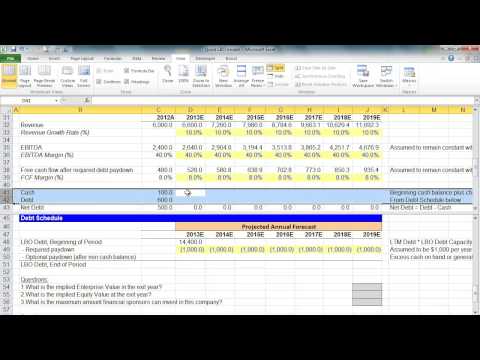

Financial Modeling Quick Lessons: Simple LBO Model (Part 1) [UPDATED]Подробнее

![Financial Modeling Quick Lessons: Simple LBO Model (Part 1) [UPDATED]](https://img.youtube.com/vi/vMzL4D8LyV0/0.jpg)

Financial Modeling Quick Lessons: Simple LBO Model (Part 3) [UPDATED]Подробнее

![Financial Modeling Quick Lessons: Simple LBO Model (Part 3) [UPDATED]](https://img.youtube.com/vi/FAu7Jvnd94k/0.jpg)

How to do a Paper LBO (MUST Know for Private Equity)Подробнее

Equity Value and Enterprise Value in Leveraged BuyoutsПодробнее

How to Use Cash Flows in an LBO Model: Debt, Dividends, and “Dough”Подробнее

Simple LBO Model - Case Study and TutorialПодробнее

IRR vs. Cash on Cash Multiples in Leveraged Buyouts and InvestmentsПодробнее

Financial Modeling Quick Lesson: Simple LBO Model (2 of 3)Подробнее

LBO Model Interview Questions: What to ExpectПодробнее

Leveraged Buyout Quick ModelПодробнее

🔴 3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return ExampleПодробнее

WST: 16.1 LBO Modeling - IRR Calculation & AnalysisПодробнее