New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator] | Income Tax

Standard deduction from salary AY 2025-2026 | #incometax #newtaxregime #oldtaxregime #shorts #itrПодробнее

Income Tax Rates For AY 2025-26 (FY 2024-25) | Income Tax Slab FY 2024-25 (AY 2025-26) | Tax RatesПодробнее

Nil Tax | New updates in Rebate u/s 87A of Income Tax for AY 2025-26|Rebate under New Tax Regime|Подробнее

Income Tax Rates for FY 2024.25, AY 2025.26 || All about New and Old Tax Slab || CA Sumit SharmaПодробнее

Standard Deduction in New Tax Regime FY 2024-25 | Standard Deduction in Old Tax Regime Income TaxПодробнее

Pay 0 % tax on profit from share market income | tax on share market income | Nil tax on LTCG profitПодробнее

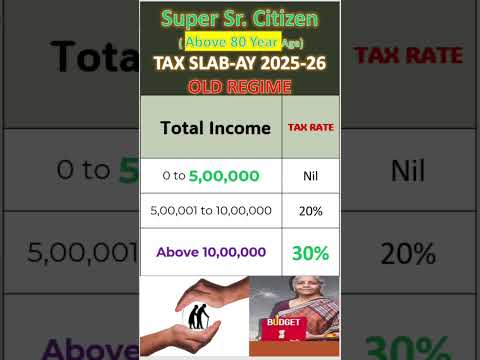

new tax slab for senior citizens FY 2024-25 | super senior citizen tax slab AY 2025-26 | tax slabПодробнее

Zero tax on 7.75 lakh Income in New tax regime without claiming any deduction & exemption| Nil tax |Подробнее

Income Tax Calculator Old Vs New Regime for FY 2024-25 (AY 2025-26) with (Excel) Automation Sheet.Подробнее

New Tax Rules of Partnership Firms | Partners Salary calculation | 194T TDS on Partners paymentsПодробнее

Capital Gains Tax on Sale of Property 🏠 Calculation - Budget 2024 Impact Without Indexation BenefitПодробнее

New TDS Rules on Salary by Budget 2024 | Tax on Salary | New Tax Regime | Old Tax Regime|section 192Подробнее

Budget 2024 impact on financial planning - Latest Income tax changes | Tax on stocks & mutual fundsПодробнее

Budget 2024 | Income Tax Calculation | How To Calculate Income Tax | New Income Tax Slab RatesПодробнее

New Tax Slab in Budget 2024 | New Income Tax Slab FY 2024-25 & AY 2025-26 | New Tax Rules 2024Подробнее

New Tax on Mutual Funds, Stocks, ETFs, Gold & Silver | Share Market LTCG STCG ExplainedПодробнее

INCOME TAX RELIEF ABOVE 7LACS TO INDIVIDUAL/SENIOR CITIZEN, Marginal Relief in New Tax Regime2024-25Подробнее

Income Tax Calculation | How To Calculate Income Tax on Salary | New Income Tax Slab Rates 2024-25Подробнее

Capital gain calculation on sale of property/land FY 2024-25 | New Tax Rate on LTCG | Income tax ActПодробнее

Pay ZERO Capital Gains Tax on Property Sale (House, Commercial, Land) in 2024Подробнее