LOW INCOME HOUSING TAX CREDIT (LIHTC) 101: QUALIFYING HOUSEHOLDS AND CALCULATING INCOME/ASSETS

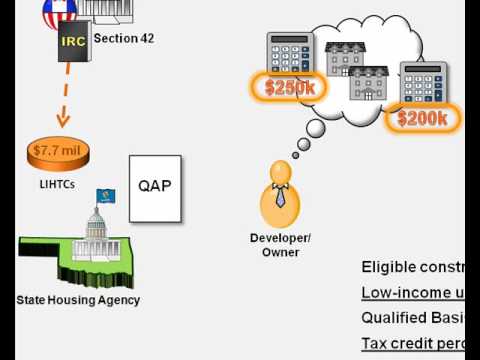

How Do LIHTC Tax Credits Work? | Low Income Housing Tax CreditПодробнее

Low Income Housing Tax Credits 101Подробнее

Low Income Housing Tax Credits (LIHTC) Compliance & ManagementПодробнее

Calculating Income from Assets for LIHTC HouseholdsПодробнее

How To Calculate Low Income Housing Tax Credits [LIHTC]Подробнее

![How To Calculate Low Income Housing Tax Credits [LIHTC]](https://img.youtube.com/vi/lSBiboJkhP4/0.jpg)

Low-Income Housing Tax Credit (LIHTC) OverviewПодробнее

Section 42 - Low-Income Housing Tax Credit (LIHTC) - Affordable Housing HeroesПодробнее

Calculating Employment Income for LIHTC HouseholdsПодробнее

Low Income Housing Tax Credits FundamentalsПодробнее

Low Income Housing Tax Credit (LIHTC) Basics & How to Get StartedПодробнее

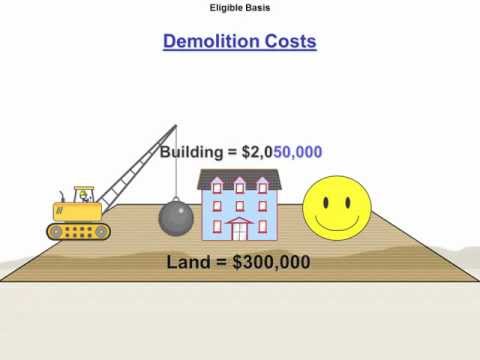

Demolition Costs, Land Improvements and LIHTC Eligible BasisПодробнее

LOW INCOME HOUSING TAX CREDIT (LIHTC) BASICS AND TIPS TO MAINTAIN COMPLIANCEПодробнее

What Is the Low Income Housing Tax Credit?Подробнее

LIHTC 101: Tax Credit BasicsПодробнее

Understanding the Low-Income Housing Tax CreditПодробнее

Three Ways to Get the 30% LIHTC Eligible Basis BoostПодробнее

2021 Low Income Housing Tax Credit FUNdamentalsПодробнее

How The IRS Calculates 4% and 9% Low Income Housing Tax Credits [LIHTC]Подробнее

![How The IRS Calculates 4% and 9% Low Income Housing Tax Credits [LIHTC]](https://img.youtube.com/vi/rq6h9rUwaIM/0.jpg)