hsn/sac is invalid or not specified | taxability type is invalid or not specified | tally prime 4.1

Sales invoice import excel in tally prime | how to import sales transaction in tally prime |Подробнее

purchase vocher import in tally prime I mported Excel to Tally Prime with Roundoff and New Ref No |Подробнее

tds on purchase in tally prime | TDS Section wise list in tally prime 5.0 | TDS in Tally 5.0Подробнее

Tally Prime 5.0 INTEREST CALCULATION | ledger interest calculation in tally prime 5.0 |Подробнее

Tcs on sales of goods entry in tally prime 4.1 | tcs adjustment And payment entry And TCS report |Подробнее

how to calculate rcm in gst with example | Tax Paid on RCM & other than RCM |Подробнее

tally prime interest calculation | Bank interest | how to enable interest in tally prime 5.0 |Подробнее

Tally Prime 5.0 | How to Automatically Generate Ledgers in Tally PrimeПодробнее

TDS 194Q entry in tally prime 4.1 | 194Q tds on purchase of goods | payment adjustment in tallyПодробнее

tds on rent journal entry in tally prime TDS on Rent entry in tally prime | payment entry in tallyПодробнее

tds on professional fees |194J TDS ON Professional & technical Services | Entry in tally prime 4.1 |Подробнее

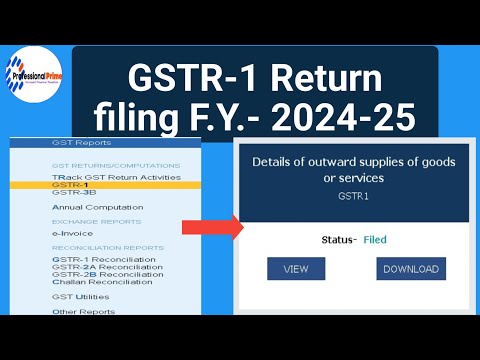

gstr1 export in tally prime 4.1 |gstr 1 return filing tally json file |gstr-1 json file not showingПодробнее

gstr1 reconciliation in tally prime | gst reconciliation in tally prime 4.1 | how to reconciliationПодробнее

2a reconciliation in tally prime | how to import 2a in tally | 2a Reconciliation 2024 25 |Подробнее

Tally prime big problem in sales invoice | how to solve |Подробнее

194A tds receivable on FD interest | 194a tds entry in tally prime 4.1 |gst on tds applicability |Подробнее

3b return filling march 2024 | how to file final 3b return month of march |Подробнее

gstr 2b reconciliation in tally prime 4.1| 2b reconciliation in tally prime | 2b in Tally 2024-25 |Подробнее

cess applicability error | mismatch in tax rate details between the master and the transaction |Подробнее