How to Calculate Portfolio Expected return Stdev, data for Efficient frontier and randarray function

How To Graph The Efficient Frontier For A Two-Stock Portfolio In ExcelПодробнее

How to Calculate Expected Return, Variance, Standard Deviation in Excel from Stocks/SharesПодробнее

Chapter 10 - Graphing Portfolio Expected Return and Standard DeviationПодробнее

Calculating Expected Portfolio Returns and Portfolio VariancesПодробнее

Portfolio Dashboard Part 8 stocks Max return, minimum variance, optimal portfolio in excel in urduПодробнее

Efficient Frontier Explained in Excel: Plotting a 3-Security PortfolioПодробнее

www.exponential.it | Mean/variance optimizationПодробнее

Calculate standard deviation, return, and minimum variance on a two-stock portfolio on Excel.Подробнее

Calculate Risk And Return Of A 3-Asset Portfolio In Excel (Expected Return And Standard Deviation)Подробнее

Fin 4300 Part 7 stock portfolio and dashboard in excel in urdu calculate Portfolio Return, StdevПодробнее

Math5670 group 3 — Portfolio optimization based on Markowitz efficient frontier and sharp ratioПодробнее

CFA® Level I Portfolio Management - Minimum Variance Portfolios and Efficient FrontierПодробнее

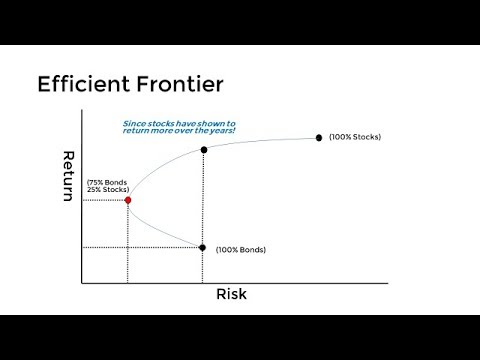

Efficient FrontierПодробнее

Excel Finance Class 105: Expected Return & Standard Deviation For Portfolio -- Estimating FutureПодробнее

Calculation Exercise - Efficient PortfoliosПодробнее

Optimize Your Portfolio with Efficient FrontierПодробнее

The Efficient Frontier - Explained in 3 MinutesПодробнее

Computing Portfolio Variance in Excel using MatricesПодробнее

Efficient Portfolio Frontier explained: Merton matrix model (Excel)Подробнее

The efficient frontierПодробнее

Which Portfolio Not On Efficient FrontierПодробнее