#5 GST Services Entry in Tally Prime |Sale & Purchase Entries for Services in Tally| Service ledger

TALLY PRIME COURSE | TDS COURSE | GST COURSE | COMPLETE PRACTICAL ACCOUNTANT COURSE IN HINDIПодробнее

SERVICE SECTOR BUSINESS ACCOUNTING IN TALLY PRIME 3.0 | ACCOUNTING INVOICE ENTRY IN TALLY PRIME 3.0Подробнее

RCM on Tally 3.0, Reverse Charge Entry on Tally Prime, RCM Entry on GSTR-3B, RCM Booking EntryПодробнее

GTA Accounting in Tally Prime | GST on GTA Services | Goods Transport Agency in Tally PrimeПодробнее

tcs in tally prime | tcs entry in tally prime | tcs on sale of goods in tally prime | tcs in talllyПодробнее

gst auto calculation problem in tally prime | GST not calculating in tallyПодробнее

Multiple GST Rate Entry in Tally Prime | Multiple GST Rate Purchase & Sales EntryПодробнее

GST Freight charge invoice in Tally Prime | Transport Bilty through Freight entry in Tally PrimeПодробнее

GST In Tally Prime | IGST, CGST, SGST In Tally Prime | purchase sale entry in tally with GST #TallyПодробнее

RCM Entry in Tally Prime | Reverse charge Entry with example in tally prime | RCM Entry in TallyПодробнее

TDS on Professional Services Entry in Tally Prime | Section 194-J | TDS Entry in Tally Prime 📚Подробнее

Sales with GST | Items, Services & As voucher with GST | Tally Prime 🔥Подробнее

TDS on Legal & Professional Services entry in Tally PrimeПодробнее

#18 || Purchase Multiple GST Rates Items || Purchase Invoice Entry in Tally Prime || #tallyprimeПодробнее

Car Service purchase with different tax rates in Tally Prime l how to pass Car Service purchaseПодробнее

How To Make Service Invoice in Tally Prime | Sales and Purchase Entry in Tally PrimeПодробнее

GST Entry in Journal Voucher | Purchase or Sale Entry in Journal Voucher with GST in Tally PrimeПодробнее

Become a Tally Prime Expert || Purchase Voucher || Sales Voucher #tallyprime #minalvkhonaПодробнее

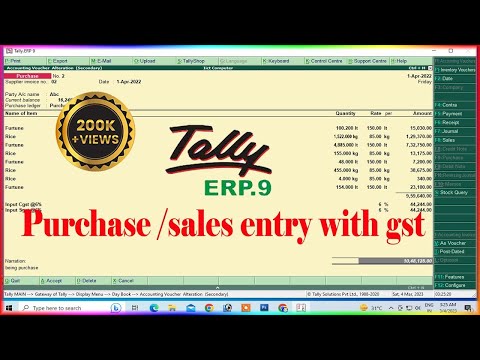

purchase and sales entry in tally erp 9 with gst in hindi | purchase and sales entry in tally erp 9Подробнее

Purchase Entry Without GST In Tally Prime | Unregistered Dealer Purchase Entry In Tally PrimeПодробнее