पिछले सालो के TDS का Refund कैसे लेवे ? | How to Get Previous Year Tax Refund | Last Year TDS Refund

How to Claim Last Year TDS Refund or Unclaimed TDS Refund From Last 6 Year | Tds Brought ForwardПодробнее

अब पुराना TDS भी Refund मिलेगा | Form 71 Income Tax कैसे भरे |Подробнее

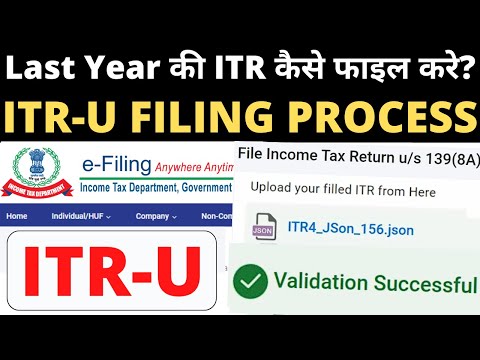

How to file 3 year old ITR U Online| F.Y 2021-22 की ITR भरे File ITR for 3 years | ITR U FilingПодробнее

Income Tax Return filing पिछले साल की ITR4 कैसे जमा करें How to file updated ITR #FarzandAliПодробнее

How to File Last Years ITR? पिछले सालो की ITR-U कैसे फाइल करे? ITR Updated Return Complete ProcessПодробнее

New form 71 Income Tax for Refund of TDS amount of Old Years पुराना TDS कैसे Refund करेПодробнее

Carry forward TDS Refund to Next year in updated return u/s 139 (8A) final ConclusionПодробнее

# How to claim Last year missed TDSПодробнее

अब पिछले 5 साल की ITR की Refund ले सकते है। #shortvideoПодробнее

How to get Old TDS Refund | TDS Refund for Previous Years, Possible?Подробнее

Income Tax Questions Practice I MCQs on TDS & TCS I Jan. 25Подробнее

Back 3 year TDS Refund Claim in updated return u/s 139(8A) | Updated return Case studyПодробнее

Claim Refund of Past 6 Years when No ITR Filed | Section 119(2)(b) | Circular No. 9/2015Подробнее

Income Tax New Form 71 | Claim TDS Return Previous Year #incometaxПодробнее

Income tax refund claim with Updated return us 139 (8A) ITRU | claim Income tax refund in ITRUПодробнее

How NRIs Can Claim TDS Refund? | NRI Taxation | Income Tax RefundПодробнее

No Income Tax : Budget में ₹15 लाख तक Income Tax Free हुई तो हर महीने इतना बचेगा पैसा!Подробнее

Tax Refund 100% | Get 100% TDS Back | How to Take Fake Tax Deduction | Effects of Fake DeductionПодробнее

Can you e-file old tax returns? | TCCПодробнее

DT Revision| TDS/ TCS Chart Revision | CA & CMA Inter Jan 25Подробнее

How to get the MAX refund on your taxesПодробнее

TDS & TCS Refund | How to claim TDSПодробнее